投资者最常问的问题

1. 现在是买2020的好时机吗?

2. 这么多豪华公寓,买家从哪里来?

3. 2020年是出售的好时机吗?

现在夏威夷的租赁市场怎么样?

The most common questions from investors

1. Is it a good time to buy 2020?

2. With so many luxury condos coming up, where are those buyers coming from?

3. Is it a good time to sell in 2020?

4. Hows the rental market in Hawaii right now?

Global Issues

Let’s take a look at 10 states with the highest negative equity rates after the housing bubble in the past.

10. Maryland

Negative equity shares: 16.2 percent

9. Rhode Island

Negative equity shares: 17 percent

8. Georgia

Negative equity shares: 18 percent

7. Michigan

Negative equity shares: 18.5 percent

6. Ohio

Negative equity shares: 19.2 percent

5. Illinois

Negative equity shares: 19.7 percent

4. Arizona

Negative equity shares: 20.1 percent

3. Mississippi

Negative equity shares: 20.1 percent

2. Florida

Negative equity shares: 26.9 percent

1. Nevada

Negative equity shares: 29.4 percent

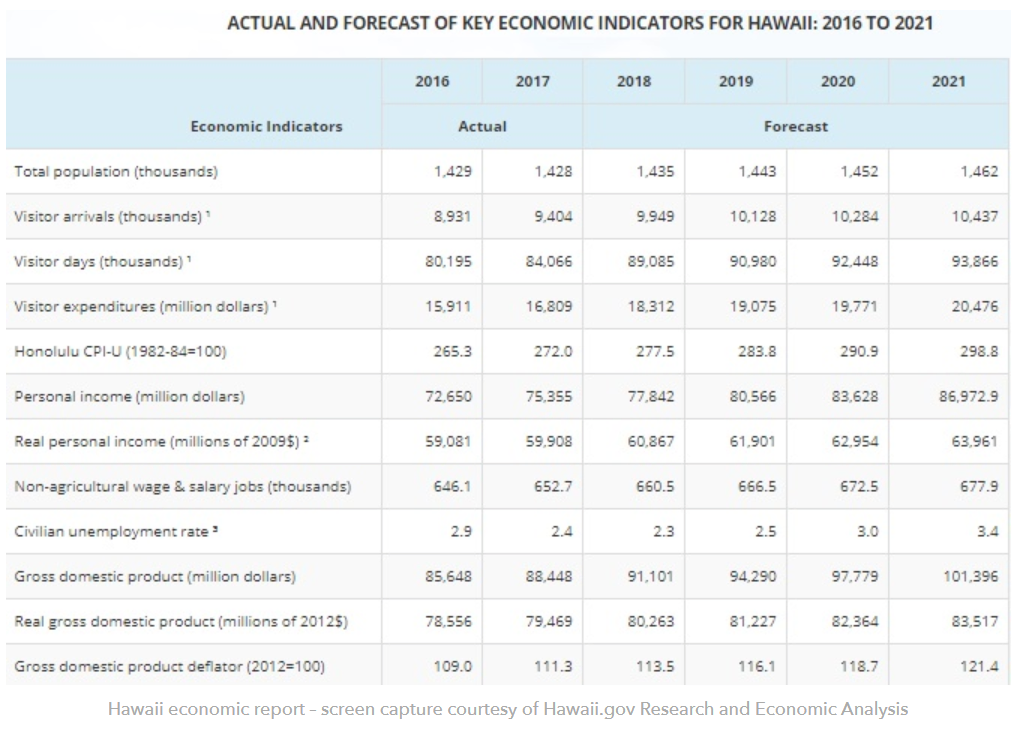

Hawaii economy: despite the trade war which affects the number of Chinese visitors to Hawaii (dropped about 36% in 2019), Hawaii's GDP is predicted to grow 2.6% in 2019 and 1.4% in 2020 and 2021. With rising wages and a good employment rate, residents will be able to support higher apartment rental prices.

夏威夷经济:尽管贸易战影响到夏威夷的中国游客人数(2019年下降约36%),但夏威夷的GDP预计将在2019年增长2.6%,在2020年和2021年增长1.4%。良好的就业率,居民将能够支付较高的租金价格。夏威夷目前也沒有租金控制的限制- 有投資人注意到有一些州開始限制租金額度-而夏威夷依然還是一個沒有限制租金的市場。

Here is the forecast into 2020 and 2021 according to Hawaii economic report by Hawaii.gov.

The Hawaiian economy is still good and wages have risen over 4%. Solid demand for rental units and new constructions. The rental market is still good in Hawaii as well as in the past.

根据Hawaii.gov的夏威夷经济报告,这是对2020年和2021年的预测。夏威夷经济依然良好,工资上涨了4%以上。租赁单元和新建筑的需求稳定。夏威夷租赁市场仍然不错

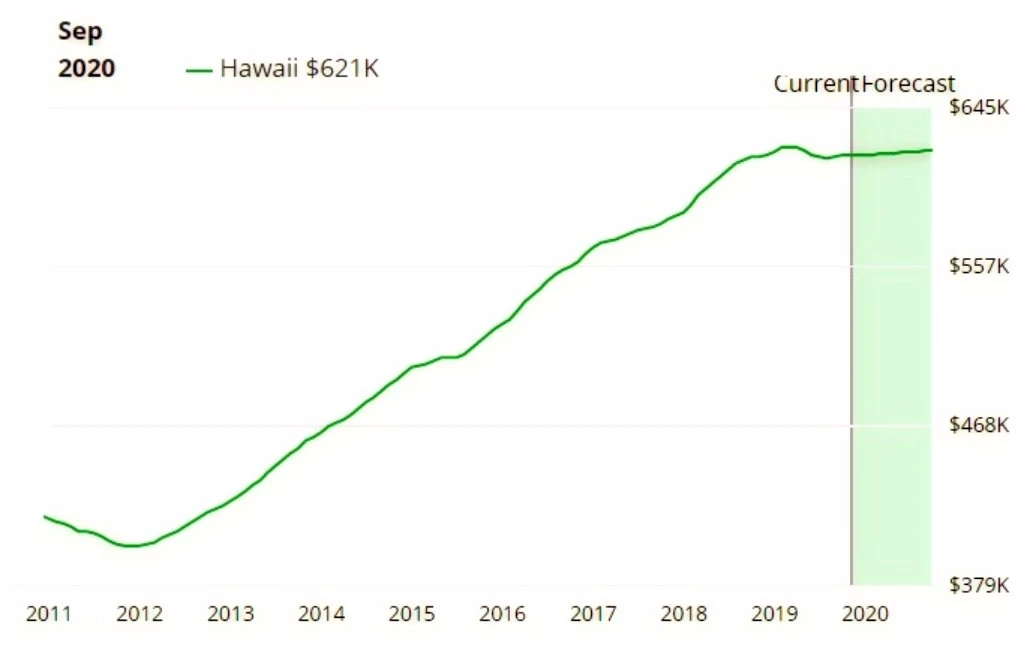

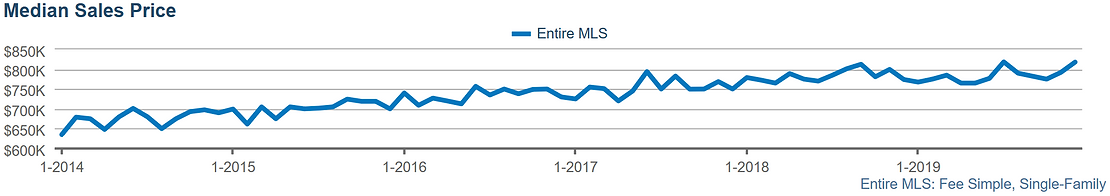

Honolulu Oahu Real Estate Forecast

檀香山瓦胡岛(Honolulu Oahu)房地产预测2019年12月的最新数据如下。正如您所看到的那样,公寓和独户住宅的中間价格仍然强劲。

The most recent December 2019 stat has come in as followed

We are finishing up 2019 with a strong number and as you can see the median price for both condo and single-family home remain strong.

由以上的圖我們可以了解夏威夷房地產的價格還是非常穩定。韓國的一位富豪收購了4塊土地在 KAPIOLANI Blvd 上,由此可見其實外資還是非常看好夏威夷前景。

-

夏威夷政府预测,到2025年,人口将增长19%。在2015-2025年期间,檀香山房地產需求量为25847套單位。瓦胡岛西邊區域,Kapolei和Ewa,仍在开发新房,房地產需求仍然很高。夏威夷不断有新士兵與其家属抵達 ,其中许多人选择在夏威夷购买房產。这也使当地居民的新房供应减少。

-

您可能想知道夏威夷的豪宅市场如何。Azure,Sky Ala Moana,Central Ala Moana,Illilani和Victoria Place等新项目在2019年已經开始销售。Azure和Sky Ala Moana的销售情况非常好,已经在建设中。Central Ala Moana銷售已經結束,Victoria Place是Kakaako最新的销售项目。这也是一线海景建筑。无限制的單位销售已经开始,并且销售不錯。自住单位也即将开始销售。这些成功的销售结果表明,夏威夷房地产市场并未像许多人预期的那样疲软。这个数字说明了一切。 而2019年 雖然許多投資人抱著觀望的態度,夏威夷房地產依然還是有不錯的數據。 300萬以上的豪宅的確在銷售上緩慢了下來不過夏威夷的房產需求仍然是高。

-

Hawaii's government predicts a 19% growth in population by 2025. Demand for Honolulu is 25847 units during the 2015-2025 period

-

The west side of Oahu, Kapolei and Ewa, is still developing new houses and the demand is still high. We have a constant influx of new soldiers and their families into the state and many of them chose to purchase homes in Hawaii. This also makes supplies of new home availability lowered for local residents.

-

You may wonder how about those luxury homes market in Hawaii. We see the new projects such as Azure, Sky Ala Moana, Central Ala Moana, Ililani, and Victoria Place starting sales in 2019. Azure and Sky Ala Moana are selling very well and are already in the middle of construction. Central Ala Moana was sold out so is Ililani. Victoria Place is the newest sale project taking place for Kakaako. This is also the first-line ocean view building. The unrestricted sale has already begun and sold very well. The owner-occupied units are about to start its sale soon. The result of those successful sales shows that the housing market is not weakened as much as many have anticipated. The number speaks for itself.

- Central Ala Moana Sold Out

2019年利率下降帮助了美国2019房地产市場. 我们不认为在2020年利率会进一步下降太多,也不一定會上漲太多。 如果投资者需要获得贷款才可以購買房地產,那麼 2020年的低利率可以幫助到您。

2019年利率下降帮助了美国2019房地产市場. 我们不认为在2020年利率会进一步下降太多,也不一定會上漲太多。 如果投资者需要获得贷款才可以購買房地產,那麼 2020年的低利率可以幫助到您。